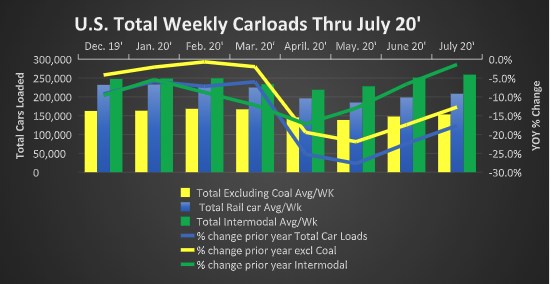

Railcar Loadings Recovery

July total U.S. Railcar loadings saw a decline of -17.6% over July 2019. Still well off 2019 levels, railcar loadings have continued to make month over month recovery gains from the lows of April and May. Excluding coal, U.S. loadings were down only -12.7%, and Intermodal loadings have almost returned to pre COVID-19 levels.

Year over year railcar loadings were down -25.2% April, -27.7% in May, -22.4% in June and now -17.6% in July. This is a significant improvement that points to signs of a U.S. economic recovery, but is still well in the throws of the unprecedented COVID-19 lockdown created a recession. Excluding coal shipments, which continue to decline as U.S. power plants continue moving toward alternative energy sources for power generation, U.S. railcar loadings were off -12.7% in July 2020 vs the same month a year ago. Possibly a better indicator of the overall economic recovery.

One particularly bright spot is intermodal rail car loadings, green in the weekly carloads chart. Intermodal loadings in July were down just -1.4% from July 2019, and at the highest level since last October.

July brings the 2020 total railcar loadings to -15.9% compared to this time last year. -10.8% excluding coal and -13.2% for total cars + intermodal.

Sector Specific Highlights:

Autos and auto parts, one of the most severely impacted railcar categories has made a significant recovery. North American carloads returned to near pre-COVID levels In July, averaging 22,863 per week. North American carloads of autos and motor vehicle parts trended roughly in the range of 21,000 - 24,000 rail cars per week in 2018 and 2019. Trend lines were right along that mark entering March 2020. As COVID lockdowns took effect, car originations reached a low of 3,290 per week in April. This recovery is significant and is seen in the new auto sales numbers for July. Sales returned to a seasonally adjusted average rate of 14.5 million new cars per year. Still down from the near 17 million seen in 2019 but a significant recovery from the April 8.7 million low.

The U.S. industrial sector remains mixed. U.S. Railcar loads of petroleum products were down -18.3% in July. Primary metal products were down -26.2% in July from 2019 levels. By comparison, chemicals were only down -5.3% in July and Forest products at -5.9%.

Economic Indicators:

Much like railcar loadings, economic indicators continue to improve but still have a historic hole to dig out from. The labor department’s jobs report indicated that almost 1.8 million net new jobs were created in July. This again exceeded expectations and the unemployment rate has ticked down to a rate of 10.2%. We reached a high of 14.7% back in April after recent lows of 3.5% as recently as February. Consumer spending continued to increase in June, up 5.6% over May. Still down -4.8% from June 2019.

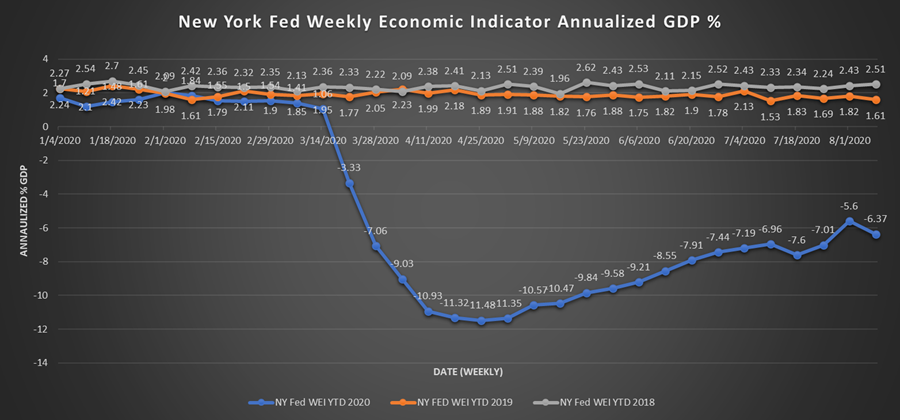

NY Fed Weekly Economic Indicator

The NY Fed’s Weekly economic indicator may be the best measure of overall U.S. economic recovery. The what is now being called “swoosh” recovery seems relatively intact. However, the data became slightly more choppy in July and the first week of August. The chart above shows annualized GDP largely in line with 2019 levels through the beginning of March. Then declining steeply to lows in late April and early May. We remain cautiously hopeful the data will continue trending toward positive levels as we move toward the end of the year.

Andress Engineering has over 60 years as a Trackmobile dealer and industrial Engineered equipment systems provider. We remain open and ready to support the operations of our  customers. We have a fleet of Trackmobiles available for rental. Our service technicians are available 24/7/365. Our Trackmobiles, cranes, and compressors operate in some of the most critical industries supporting our economy.

customers. We have a fleet of Trackmobiles available for rental. Our service technicians are available 24/7/365. Our Trackmobiles, cranes, and compressors operate in some of the most critical industries supporting our economy.